(Photo: Iowa Soybean Association / Bethany Baratta)

Reducing soy transportation costs

October 1, 2024 | Bethany Baratta

When Soy Transportation Executive Director (STC) Mike Steenhoek opens the weekly data provided by the U.S. Department of Agriculture’s Agricultural Marketing Service showing weekly cost indices of transporting grain by truck, rail, barge, and ocean-going vessels, he sees opportunity.

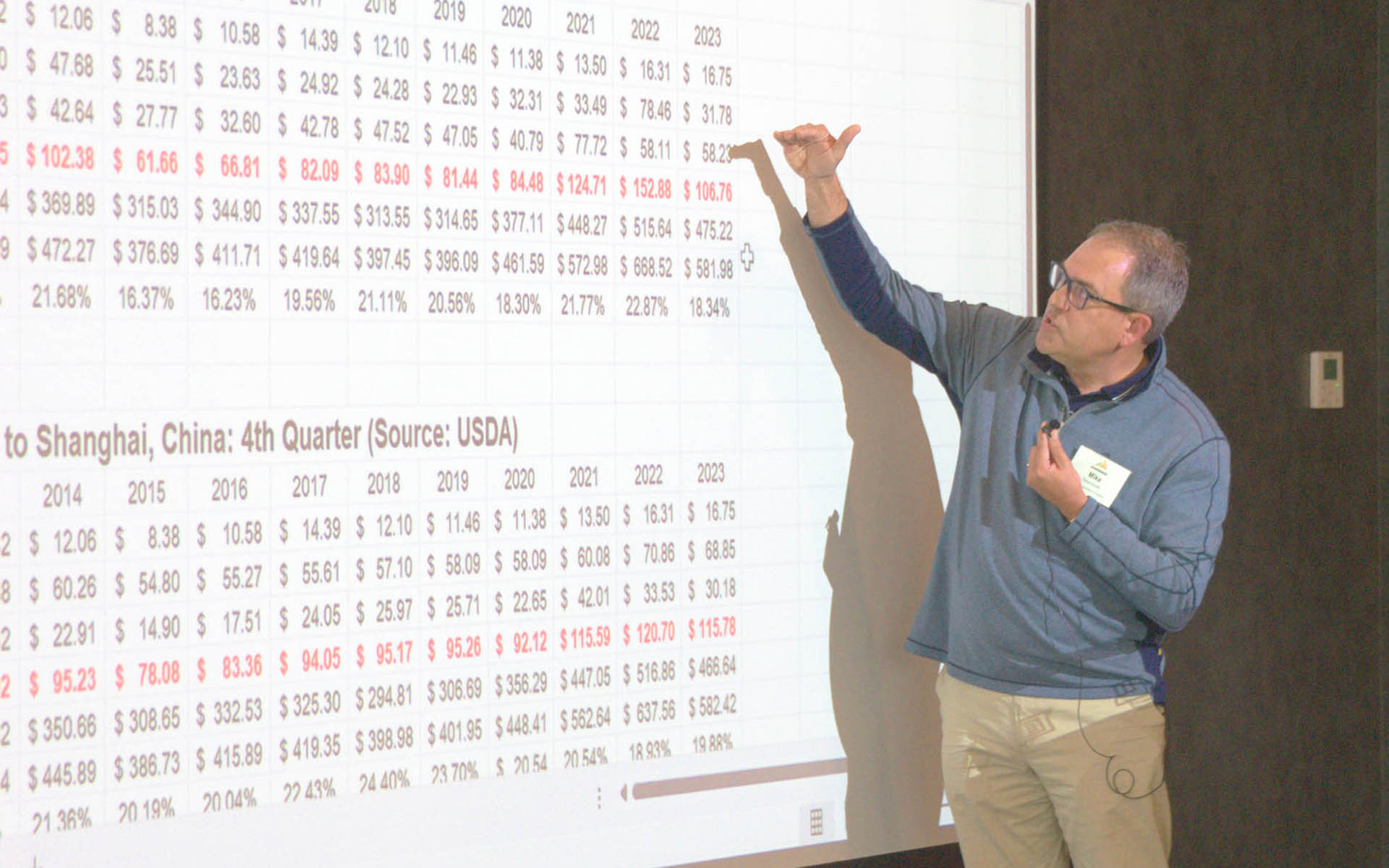

“Our competitive advantage is eroding,” Steenhoek tells the STC Board of Directors during their meeting along the Columbia River in Washington, pointing to his spreadsheet projected on the screen. About 25% of soybean exports leave from the Pacific Northwest annually. This particular hotel conference room is the former site of the G.M. Standifer Wood Shipyard, built for World War I efforts.

He updates his Microsoft Excel workbook to track the costs of moving one metric ton of soybeans (or 36.74 bushels) from various points like Davenport, Sioux Falls and northern Mato Grosso, Brazil, to Shanghai, China. And then he gets to work.

Steenhoek talks about the complexities of soy transportation infrastructure; how droughts and low river levels impact the transportation of soybeans on the Mississippi River. How Hurricane Ida impacted soy shipments on the Gulf. How attacks on shipping near the Bab el-Mandeb Strait limited shipping through the Suez Canal, forcing ag exporters in the Mississippi Gulf region to utilize the Cape of Good Hope

route along the southern tip of Africa to get products to Japan.

He presents the Excel sheet like a playbook to the board; he uses it to demonstrate the United States’ diminishing competitive advantage when he’s making the case for reliable and efficient soy transportation opportunities in D.C. offices.

In red, bold font, the total transportation cost, including truck, barge and ocean rates, associated with getting the soybeans to China. Once double the cost to ship soybeans from northern Mato Grosso, Brazil, there’s now just a $30 per ton difference between U.S. and Brazil origins.

“That cost comparison has significantly curtailed,” Steenhoek says plainly. “One of the conversations we need to increasingly have as an industry is how you attack the number.”

So what does ‘attacking the number’ mean?

It means going after that $30 per ton difference.

And that’s why the Soy Transportation Coalition, comprised of 14 state soybean boards, the American Soybean Association, and the United Soybean Board, is focused on projects in a wide range of scope and scale. From increasing weight limits permitted on highways to expanding capacity of our locks and dams and supporting rail projects that remove log jams to get soy from Iowa farms to customers around the world, it all plays into the competitive advantage the United States has over other exporters.

“We try to make that (transportation cost) number as small as possible because that’s a cost barrier between you as a farmer and the customer over there,” he says to the farmer-leader board. “The smaller that number is, the more you’re facilitating that exchange. The bigger the number, the more of an obstacle it is.”

Back