(Graph: Ever.Ag Insights)

Little change in WASDE numbers

October 17, 2024

No major fluctuations were evident in the October World Agricultural Supply and Demand Estimates (WASDE) report from the U.S. Department of Agriculture (USDA).

U.S. oilseed production for 2024/25 is forecast at 134.4 million tons, down 300,000 from September with lower soybean, cottonseed, peanut, and sunflower seed production partly offset by higher canola production.

Soybean production is forecast at 4.6 billion bushels, down 4 million on lower yields. The harvested area is unchanged at 86.3 million acres. The soybean yield is projected at 53.1 bushels per acre, down 0.1 bushels from the September forecast. With lower production partly offset by slightly higher beginning stocks, supplies are lowered 2 million bushels to 4.9 billion. With a slightly lower residual and no change to exports and crush, ending stocks are unchanged from last month at 550 million bushels. The U.S. season-average soybean price for 2024/25 is unchanged at $10.80 per bushel. Soybean meal and oil prices are also unchanged at $320 per short ton and 42 cents per pound, respectively.

“The soybean ending stock estimate did not change from the previous month. Although the soybean yield decreased, it was only by a tenth of a bushel,” says Kristin Stien a senior grain market advisor from Ever.Ag in Benton County. “From soybean producers that I speak with, yields are solid but could have been better if the bean moisture were higher. This likely could have led to yield backing off slightly.”

Stien noted that amidst a "lower" yield, the United States is still showing a record high for production, at 4.582 billion bushels and after demand is taken off, a massive 550 million bushel carryout.

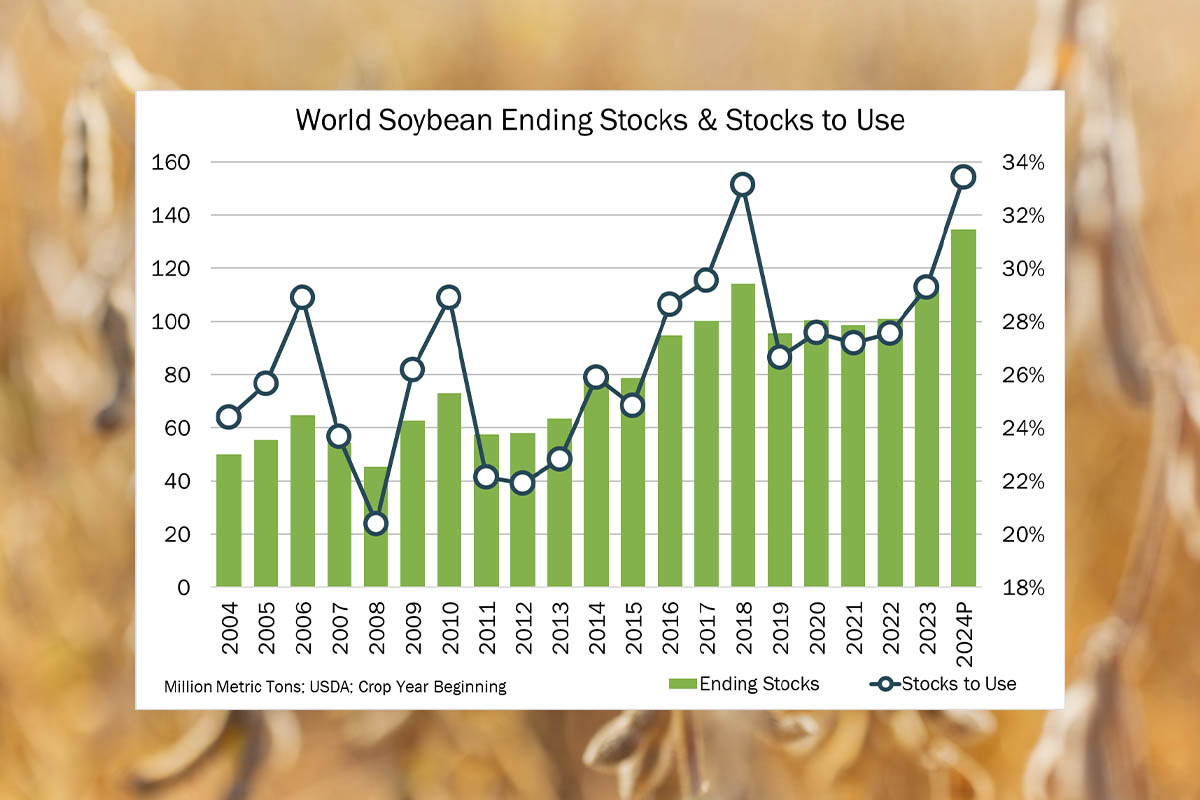

“When you couple that with the massive world ending stocks of 134.65 million metric tons, a lot of pressure could be had on this market,” she says.

Foreign numbers

In the latest WASDE report, foreign 2024/25 oilseed production is increased 200,000 tons to 552.9 million mainly on higher sunflower seed and cottonseed partly offset by lower rapeseed and soybean production. Sunflower seed production is raised for Argentina and Moldova mainly on higher area. Rapeseed production is lowered for the EU, Moldova, and Ukraine on lower area and harvest results.

Soybean production is lowered for Ukraine on harvest results. Another notable revision is lower palm oil production for Indonesia for 2022/23 and 2023/24, guided by domestic estimates and lower-than-expected reported exports to date. Global 2024/25 soybean exports are lowered 0.1 million 100,000 tons to 181.5 million with lower exports for Ukraine. Soybean imports and crush are lowered for Thailand. Global soybean ending stocks are up 100,000 to 134.6 million with higher stocks for China, Argentina, and Brazil mostly offset by lower stocks for Ukraine, Türkiye, and Iran.

“Brazil and Argentina are in the early stages of their growing season and weather is starting to provide some relief to their drought,” Stien says.

And while she thinks U.S. domestic crush numbers will continue to grow throughout this marketing year, Stien offers this warning:

“I'd be doing a disservice to Iowa Soybean Association members to not keep my eyes and focus on the world ending stocks to use ratio,” she says.

The next WASDE report is slated for Nov. 8.

Back