(Graph: Ever.Ag Insights)

WASDE: Lower production numbers revealed

November 14, 2024

The U.S. Department of Agriculture late last week lowered its forecasts for the soybean harvests based on the latest conditions, but the new numbers were not enough to raise the department’s price estimates for this year’s crops.

In its November World Agricultural Supply and Demand Estimates (WASDE) report, the USDA estimates soybean production this year at 4.5 billion bushels, down 121 million or 3% below the October forecast but 7% more than farmers harvested a year ago. That would indicate the second largest soybean harvest in U.S. history. USDA reduced its estimated average yield this fall from 53.1 bushels to 51.7 per acre.

In the WASDE report, the most significant production adjustments were made for Iowa, Illinois and Minnesota.

The WASDE report also cut back its forecast for soybean exports by 25 million bushels for the 2024-25 marketing year to 1.8 billion, citing “lower supplies and sales to date.” Estimated ending stocks for the marketing year were lowered 80 million bushels to 470 million.

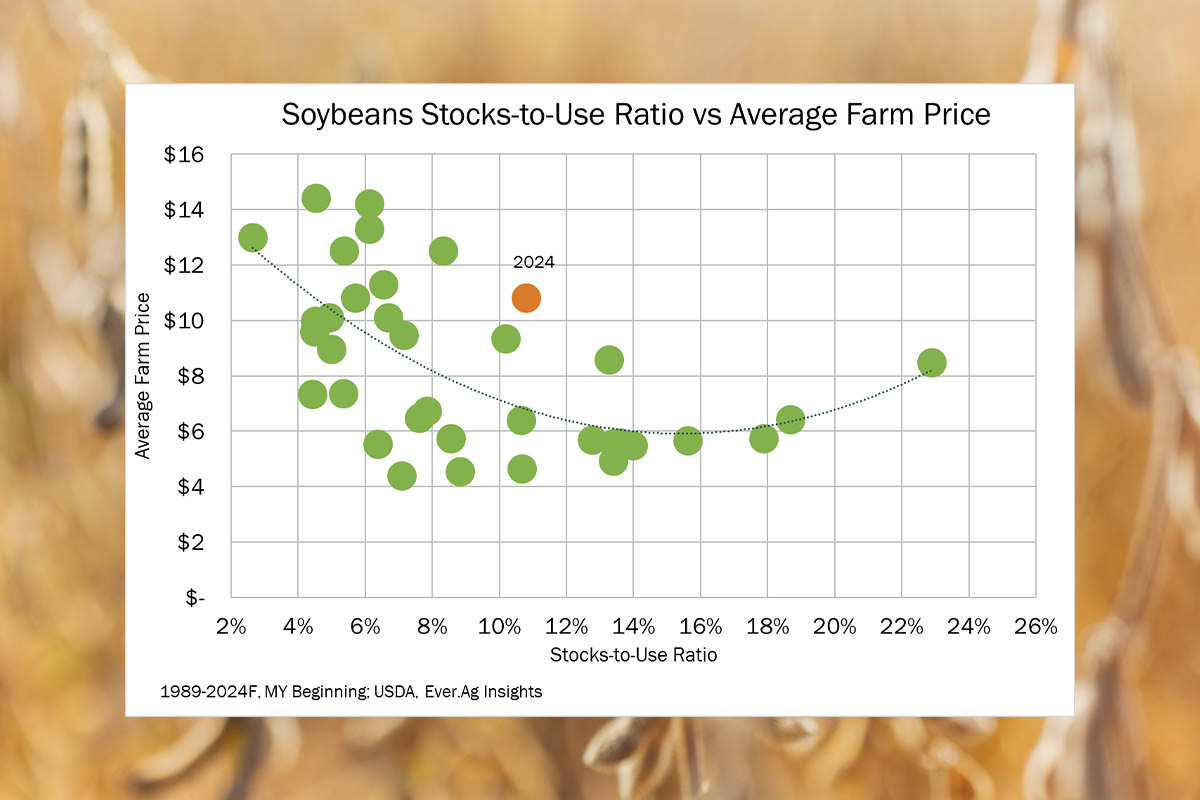

USDA maintained its estimated farm-gate prices for soybeans at $10.80 per bushel, down from $12.40 on last year's crop.

The soybean meal price is unchanged at $320 per short ton, while the soybean oil price is increased to 1 cent to 43 cents per pound.

Meanwhile, the global 2024/25 soybean supply and demand forecast includes lower production, higher exports, lower crush and lower ending stocks. Global 2024/25 soybean production is lowered 3.5 million tons to 425.4 million, mainly on lower production for the United States and India.

Global soybean exports are raised on higher shipments for Brazil, Canada and Benin largely offset by lower U.S. shipments. Global soybean ending stocks are reduced 2.9 million tons to 131.7 million mainly on lower stocks for the United States, Brazil, and Argentina.

In a separate report Friday, the UN Food and Agriculture Organization said its index of prices for global food commodities jumped 2% in October to its highest level since April 2023, driven by higher prices for vegetable oils, grains and dairy products.

The index for vegetable oils shot up 7.3% in October, led by price increases for palm, soybean, sunflower and rapeseed oils. The increase in soybean oil prices was due to “firm global demand amid limited supplies of alternative vegetable oils,” the FAO said.

The ‘big crops get bigger’ exception

“The market was certainly surprised with the lower yields that were posted,” says Kristin Stien, senior grain marketing advisor for Ever.Ag. “Given the dry conditions that fall presented and many reports of 8% beans coming in off the combine, one could say that this year makes sense to be the exception to the rule of ‘big crops get bigger.’”

She says had this drop in yield and production been during a year that the United State and the world were sitting on tight stocks, it would have been a wildly bullish report.

“What the market now has to decipher is how bullish it needs to be,” Stien says. “When looking at the attached chart, it's easy to assume that anything above $10 is a gift to be taken advantage of.”

As to what’s next, all eyes will be pointed at the Southern Hemisphere.

“South American production will continue to be the focus, now that the election and WASDE is over,” says Stien. “Issues with South American weather may help support the market; but if a confirmation of an awesome crop occurs, substantial downside risk is still in front of the bean market.”

Back